Auto Negligence Demand Letters

Published: 6/30/2022

Personal injury demand letters are a cornerstone of the claims process after an auto accident. They formally kick off negotiations with the at-fault party's insurer and set the tone for how your case will proceed. In Georgia auto accident cases, a well-crafted demand letter can make the difference between a fair settlement and a prolonged legal battle.

Purpose of a Demand Letter in Auto Accident Claims

Personal injury demand letters serve several important purposes in an auto accident claim:

-

Initiating Settlement Discussions: A demand letter is typically the formal initiation of the claims process. It notifies the at-fault driver’s insurance company of your injury claim and opens the door to serious settlement negotiations. In fact, many cases shift from informal talks to serious settlement negotiations once the demand letter is received.

-

Presenting Facts, Liability, and Damages: The letter acts as a clear communication channel that outlines the details of the accident, explains how the other driver was liable, and describes the injuries and losses you suffered. By presenting a comprehensive overview of the case, including evidence of fault and the extent of damages, the demand letter ensures both you and the insurer are on the same page about what happened and why the insured is responsible. It demonstrates the strength and validity of your case, giving the insurance adjuster the information needed to evaluate your claim’s merit.

-

Setting the Stage for Negotiation: A demand letter also establishes the initial parameters for negotiation. It specifies the amount of compensation you are seeking and provides a rationale for that amount. This effectively sets a starting point or anchor for the settlement discussion. By laying out a detailed account of the incident, the injuries sustained, and the financial compensation sought, the letter frames the value of the case in the best light and helps steer the back-and-forth dialogue that follows. The insurance company now has a figure and justification on the table to respond to, which can streamline negotiations toward a resolution.

-

Conveying Urgency and Seriousness: A well-drafted demand letter signals to the insurer that you are serious about pursuing full compensation. It creates a sense of urgency by making clear you expect a prompt response and are prepared to take further action if needed. In Georgia, where statutes of limitation impose deadlines on injury claims, this urgency can expedite the process. Essentially, the letter puts the insurer on notice that you will not let the claim languish.

-

Creating a Record (Good-Faith Effort): Finally, the demand letter creates a paper trail of your attempt to resolve the matter amicably. If settlement talks break down, that letter becomes evidence that you made a good-faith effort to settle before resorting to litigation. It documents the facts, the damages claimed, and the compensation you requested, which can be valuable if the case proceeds to court. Should you file a lawsuit, the demand letter shows the court (and potentially a jury) that the insurance company had an opportunity to settle for a reasonable amount but failed to do so. This record can lay groundwork for any future legal action, including potential claims of bad-faith against the insurer if they unreasonably refused to settle.

Key Components of an Effective Auto Accident Demand Letter

An effective demand letter is clear, detailed, and well-organized, covering all the information the insurance company needs to evaluate the claim. While you should avoid turning it into a step-by-step template, most strong auto accident demand letters include common core elements:

-

Background of the Accident: Begin with a concise summary of the accident facts – the date, time, location, and a description of how the crash occurred. Present the events chronologically and factually. This section should also establish liability, explaining why the other driver (the insured) was at fault. Reference any relevant traffic laws or negligence principles to solidify the legal basis for the other party’s responsibility. For example, you might note that the other driver violated a traffic statute or was cited in the police report, indicating clear fault. The goal is to leave no doubt about who caused the accident and why the insurer’s client is liable.

-

Injuries and Medical Treatment: Next, detail the injuries you sustained and your medical treatment. List your diagnoses (for example, whiplash, concussion, broken arm) and describe symptoms or limitations you experienced. Provide a summary of the medical care received – hospital visits, surgeries or procedures, rehabilitation, physical therapy, follow-up appointments, etc. – and note your current status and prognosis. This section shows the extent of your bodily injuries and health impact, demonstrating the severity of the harm caused by the accident. It’s important to be factual and thorough, as this builds the case for your damages.

-

Documentation of Damages: An effective demand letter itemizes the damages you suffered, both economic and non-economic. It should include a breakdown of all financial losses (“special damages”) with dollar amounts, such as medical bills (with totals from providers), prescription costs, rehabilitation expenses, and any future medical costs if ongoing treatment is expected. Also include lost wages or income – for example, “8 weeks of missed work, totaling $X in lost earnings.” If your injuries caused lasting impairment affecting earning capacity, note that as well. Attach or cite supporting documents like medical bills, invoices, and employer wage statements to back up these numbers. In addition, outline your non-economic damages (sometimes called “general damages”) such as pain and suffering, mental anguish, emotional distress, and loss of enjoyment of life. While these are not as easily quantified, describe in personal terms how the injuries affected your daily life, hobbies, and relationships. For instance, mention difficulty sleeping due to pain, or missing important life events during recovery. By providing a comprehensive list of your economic and non-economic damages, the letter gives the insurer a full picture of your losses.

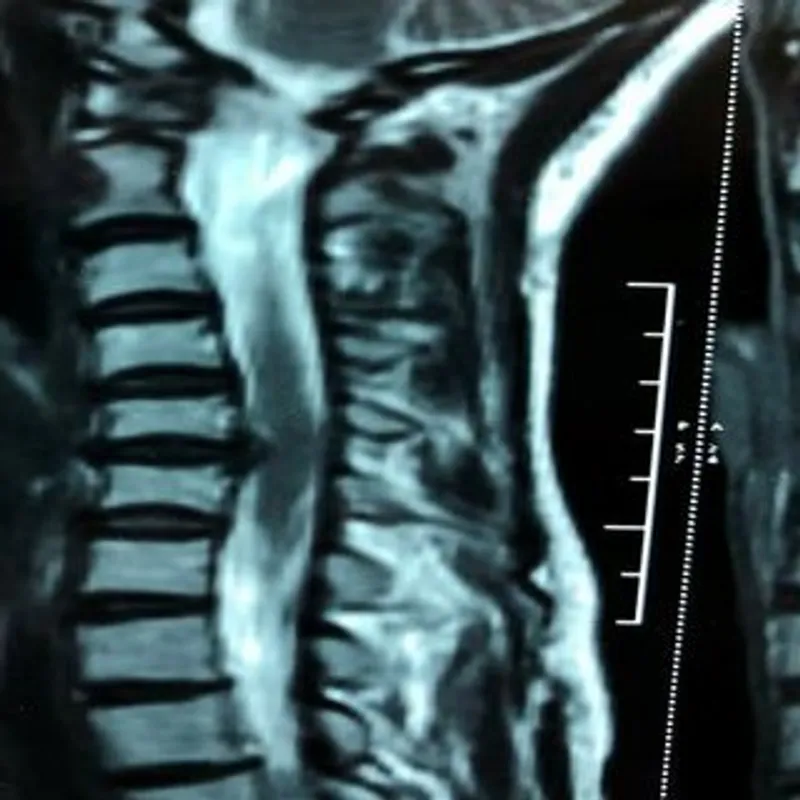

Supporting Evidence: Along with describing damages, a strong demand letter references and encloses key evidence to substantiate your claims. Common attachments (or enclosures) include copies of medical records and doctors’ reports, medical bills and receipts, the police accident report, repair estimates or photos for vehicle damage, witness statements, and any relevant photographs (such as pictures of your injuries or the crash scene). For example, you might attach the emergency room report and X-ray showing a fractured bone, or the police report indicating the other driver was cited for running a red light. Providing these documents up front strengthens your case by allowing the adjuster to verify the facts and evaluate the claim. In Georgia, a pre-suit demand must include medical records sufficient for the insurer to assess the claim. Including solid evidence with the letter shows you can prove your allegations and justifies the compensation you’re asking for.

Demand for Compensation: Clearly state the specific amount of money you are seeking as a settlement. This is the “demand” part of the letter. It often comes after explaining the injuries and losses, so that the requested sum is supported by what’s been described. You can present this as a lump sum (for example, “In light of the above, we hereby demand $___ to resolve this claim.”), or break it down by category (medical expenses, lost wages, etc., plus an amount for pain and suffering) to show how you arrived at the total. Being specific is important – the insurer needs to know exactly what amount would settle the claim. Make sure the demand is reasonable and proportional to the documented losses; an excessively high figure with no basis can undermine your credibility. It’s common practice to demand somewhat more than what you’d be willing to accept, leaving room for negotiation, but it must be within a plausible range given the facts. This number sets the bar for negotiations moving forward.

- Deadline and Next Steps: It is wise to include a time limit for the insurance company’s response. In Georgia, formal settlement demands must give the insurer at least 30 days to reply. You might write, “Please respond within 30 days of receipt of this letter,” or specify an actual date. Setting a deadline conveys urgency and helps prevent the insurer from dragging their feet indefinitely. Finally, the letter typically ends by stating your intent to take further legal action if necessary. This means politely but firmly noting that if the insurance company does not agree to a fair settlement, you reserve the right to file a lawsuit to pursue the claim. For instance, “If we do not receive an acceptable response by the deadline, my client will proceed with filing a personal injury lawsuit in Georgia court.” This isn’t about threatening for the sake of it – it’s about making clear that you are prepared to enforce your rights. By mentioning litigation as the next step, you underscore that the demand letter is a serious opportunity to resolve the matter now, rather than later in court.

Best practice is to ensure the tone of the letter is professional, factual, and organized. It should read like a persuasive legal brief, not an emotional plea. An organized structure (facts → liability → injuries → damages → demand) with headings or paragraphs for each topic can improve clarity. Many attorneys draft demand letters in a way that if a stranger read it, they would understand the entire case and why the requested amount is justified. The letter’s quality can directly impact how the insurer values the claim – a well-documented, logically presented demand signals that you are ready to win your case, which can encourage a more favorable offer.

Legal Considerations and Best Practices Under Georgia Law

If your auto accident occurred in Georgia, there are specific legal considerations and statutes that come into play when sending a personal injury demand letter. Georgia has particular rules governing pre-suit settlement demands, especially for motor vehicle injury claims, that both claimants and insurance companies must heed. Here are key Georgia legal points and best practices to keep in mind:

Georgia’s 30-Day Time-Limited Demand (O.C.G.A. § 9-11-67.1): Georgia law sets out formal requirements for any pre-litigation offer to settle a personal injury claim from a motor vehicle accident. Under this statute, a settlement offer (demand) made before a lawsuit is filed must be in writing and must contain certain material terms. Notably, the demand must specify a deadline of at least 30 days for the recipient (the insurer) to accept the offer. In other words, you cannot demand that the insurance company pay by, say, next week; you have to give them a minimum of 30 days from when they receive your letter to respond. The demand must also state the amount of monetary payment sought and identify the party or parties to be released from liability if the offer is accepted. Additionally, it should clarify whether the release would be full or limited and which claims would be released. These requirements are designed to make settlement demands clear and fair, preventing “gotcha” tactics. Always include these essential terms in any Georgia demand letter – a clear payment amount and a 30-day (or more) window to accept – so that your demand complies with the statute.

Include Sufficient Supporting Records: Georgia’s law also requires that a pre-suit demand include relevant records that allow the insurer to evaluate the claim. This typically means you should attach key evidence like medical records and bills related to your injuries. The idea is that the insurance company should have enough information in hand to make an informed decision within that 30-day window. If you fail to provide documentation of your injuries or damages, the insurer might argue the demand wasn’t valid under the statute. Best practice is to enclose all pertinent bills, medical reports, and accident reports with the demand package, or at least offer to provide anything reasonable the insurer requests. A complete demand package strengthens your position and leaves the insurer little excuse to delay.

Insurance Response Timeframes: By custom and statute in Georgia, insurance carriers generally have 30 days to respond to a third-party personal injury demand letter; for claims involving your own uninsured/underinsured motorist (UM/UIM) coverage, Georgia law actually gives your UM insurance carrier 60 days to respond to a settlement demand. So if you are also making a demand on your own UM policy (for example, if the at-fault driver had low insurance limits), be aware of that longer timeframe. While waiting can be frustrating, these windows are in place to allow insurers time to investigate and make a decision. Mark your calendar when you send the demand, because if 30 days (or 60 for UM) pass with no response, you may have the option to withdraw the offer and proceed to file suit or take further action. In any case, patience and promptness are both key – give the insurer the required time, but be ready to act if the deadline passes without a satisfactory answer.

Georgia’s “Holt Demand” and Bad Faith Exposure: One reason demand letters are so pivotal in Georgia is because of the state’s stance on insurer bad faith in settlement negotiations. In the landmark case Southern General Ins. Co. v. Holt (1992), the Georgia Supreme Court held that an insurer that unreasonably refuses to settle a clear-cut claim within policy limits can be liable for a judgment in excess of the policy limits. In practice, this means if you send a proper policy-limits demand that meets all legal requirements and the insurer negligently or in bad faith fails to accept it, they could end up paying much more if the case goes to trial and the verdict exceeds the policy coverage. Such time-sensitive policy-limit demands in Georgia are often called “Holt demands.” Georgia’s legislature later codified rules to govern these situations and curb abuses. For claimants, the takeaway is that a well-crafted demand letter can put pressure on the insurer: they know that if they ignore a reasonable settlement offer and a jury later awards more, they might be on the hook for the whole amount, not just their policy. To preserve a potential bad-faith claim, make sure your demand strictly complies with Georgia’s requirements (proper terms, timeframe, and delivery). While you should always negotiate in good faith, don’t undervalue your claim – the law is there to encourage insurers to pay legitimate claims rather than gamble and face extra liability.

Statute of Limitations and Timing: Under Georgia law, the statute of limitations for personal injury claims (including car accidents) is two years from the date of the injury. This means you generally have two years to file a lawsuit, or you lose the right to do so. When sending a demand letter, this deadline is crucial. Do not wait until the last minute to send a demand, as you want to leave enough time – both for the insurer to respond within the 30 days and for you to still file suit if negotiations fail. A common best practice in Georgia is to send the demand letter well before the two-year mark, often once you have concluded medical treatment or reached maximum medical improvement. This way, you have documented all your damages and still have ample time to litigate if needed. Also, keep in mind that if the two-year deadline is near, a late demand letter won’t extend it – only filing a lawsuit stops the clock. In summary, be mindful of the limitations period and aim to resolve or escalate your claim before the statute runs out.

Delivery and Format: While not mandated by statute, it is wise to send Georgia demand letters via a traceable delivery method (such as certified mail, FedEx, or email/fax with confirmation) so you have proof of when the insurance company received it. Demands are often sent via certified mail with return receipt to document the start of the 30-day period. Also, clearly label your letter as a formal settlement offer and indicate that it is pursuant to the relevant statute if you are invoking that statute for a policy-limits demand. Some attorneys even include a copy of the statute or explicitly quote the required terms to eliminate any doubt. By dotting these i’s and crossing t’s, you ensure your demand letter carries legal weight.

In Georgia, following these legal considerations and best practices means your demand letter will not only be persuasive but also enforceable. It sets you up to either achieve a fair settlement or, if the insurer is recalcitrant, pursue further legal remedies (like a bad-faith claim) with confidence that you gave the insurance company a proper chance to settle.

Common Mistakes to Avoid in a Demand Letter

Drafting a personal injury demand letter requires care and accuracy. Certain mistakes can weaken your position or delay the claims process. Here are some common pitfalls to avoid when writing an auto accident demand letter:

Exaggerating or Misrepresenting Facts: It may be tempting to paint the accident or your injuries in the worst light possible, but overstating your case can backfire. Insurance adjusters are trained to spot inconsistencies and over-the-top, exaggerated, or knowingly inaccurate claims. Any hint of exaggeration will damage your credibility. Stick to the facts and be truthful about your injuries and losses. For example, don’t claim you were going 25 mph if the police report says 10 mph, and don’t inflate your pain levels beyond what’s in your medical records. Honesty and accuracy are paramount – a single lie or overstatement can cast doubt on all your legitimate claims.

Making Unrealistic Demands: Demanding a wildly excessive amount of money that has no grounding in your actual damages is a serious mistake. Your requested compensation should be supported by the facts. If your medical bills and lost wages amount to $20,000, demanding $500,000 without a compelling reason (like very severe permanent injuries) would be seen as unrealistic. It’s fine to aim high in negotiations, but the figure should still make sense in context. An unsupported demand can lead the insurer to not take your letter seriously or respond with a token low offer. Make sure to calculate all your damages fully – and don’t undervalue either – but avoid pie-in-the-sky numbers that undermine the legitimacy of your claim.

Insufficient Documentation: A very common mistake is failing to include copies of key documents or evidence with your demand. If you assert you have $15,000 in medical bills or that you missed a month of work, you need to provide proof. Missing documentation forces the adjuster to hunt for information or doubt your claims. Always attach or include all relevant records, such as medical bills, doctor’s reports, the police report, pay stubs for lost income, etc. Also, clearly reference those attachments in your letter. Without supporting documents, a demand letter is just allegations on paper. Don’t make the insurer’s job harder – lay out the proof. A complete demand package shows you mean business and have the evidence to back up every item of damage you are claiming.

Overlooking Important Details (or Bad Facts): Sometimes in an effort to present your case favorably, you might be inclined to omit any “bad” facts – but the insurance company likely already knows them. Neglecting to include important details or evidence (especially if it’s something the insurer is aware of) can hurt your credibility. For example, if you had a prior injury to the same body part, or if there’s evidence you were partly at fault, it’s often better to address it briefly in the letter rather than ignore it. Acknowledge the fact and then explain why it doesn’t reduce the other driver’s liability (or its impact on your claim). This way, you come across as transparent and prepared, rather than the insurer thinking they caught you hiding something. Detail matters – double-check names, dates, and amounts in your letter for accuracy. Typos or factual mistakes can also be problematic, as they suggest carelessness. Review everything to ensure your demand letter is factually precise and complete.

Using Aggressive or Unprofessional Language: While a demand letter is an advocacy piece, it should always maintain a professional, respectful tone. Avoid threats, insults, or overly emotional pleas. Phrases like “Your company must pay up or else!” or attacking the at-fault driver’s character are inappropriate and can alienate the reader. An adjuster is more likely to respond well to a calm, factual presentation than to combative or confrontational language. Similarly, do not make legal threats you’re not prepared to follow through on – politely reserving the right to litigate is fine, but ranting about how you’ll ruin the company in court is not. Keep the letter courteous and firm. The tone should reflect that you know your rights and the value of your case, but you are also reasonable and open to resolving the matter amicably. Striking that balance in tone can encourage a more productive negotiation. An overly aggressive or emotional letter, on the other hand, might lead the insurer to dig in their heels or respond through their attorneys instead of negotiating.

By avoiding these mistakes – exaggeration, unsupported demands, poor documentation, ignoring key facts, and unprofessional tone – you increase the effectiveness of your demand letter. In short, be truthful, be thorough, and be tactful. A well-prepared demand letter builds trust and sets you up for a more favorable response; a sloppy or extreme one can stall your claim or weaken your bargaining position.

The Role of Demand Letters in Settlement Negotiations

A personal injury demand letter doesn’t just fire off your claim and disappear – it actively shapes the negotiation process that follows. Once the insurance company receives your demand, it will trigger a series of responses and strategic decisions on their end. Understanding how demand letters influence these negotiations can help you anticipate the next steps.

Influencing the Insurer’s Response: Insurance companies rarely just pay the demanded amount immediately (especially if the amount is substantial). Instead, the demand letter will prompt the insurer to evaluate the claim and formulate a response. Typically, one of a few things will happen: (1) The insurer may accept the demand outright, agreeing to pay what you asked – this is uncommon but possible in very clear-cut cases or when your figure is reasonable and within policy limits. (2) More often, they will issue a counteroffer for a lower amount, which begins the negotiation process. (3) Or, the insurer might deny liability or refuse to pay, effectively rejecting your demand – at which point you would consider filing a lawsuit. The demand letter frames these interactions. Because you presented a detailed claim and a specific dollar amount, the insurance adjuster now has a basis to work from. In many cases, the adjuster must write an internal report or get authority for settlement. Your demand letter gives the adjuster “ammunition” and evidence to justify paying you a certain amount. A strong demand package can empower an adjuster to seek a higher settlement reserve from their supervisors. In this way, the thoroughness and quality of your demand letter directly affect whether the insurer’s counteroffer is in a reasonable ballpark or insultingly low.

Insurance Company Tactics: Insurance companies are businesses, and even when faced with a solid demand letter, they often employ tactics to save money. One common response to any demand is sending a “reservation of rights” letter, which the insurer will issue to state that they are investigating your claim and reserve the right to deny it later on. This is routine and not a cause for panic – it’s basically legal language to protect their interests. After that, the insurer might counter with what’s known as a lowball offer, an amount far less than your demand (and usually lower than what they’re truly willing to pay). This is a negotiation strategy: they try to see if you’ll jump at a low offer or how firmly you’ll stand by your claim. They may also try to delay responding until close to the deadline, use your medical history or any gaps in treatment to question your injuries, or argue that some of your treatment was excessive. These tactics are aimed at undermining your claim’s value and seeing if you’ll settle for less. By anticipating them, you (and your attorney) can be prepared to counter. For example, if a low offer comes, you can reply with a well-reasoned counter highlighting the evidence of higher damages, or pointing out that their insured was clearly at fault and thus full compensation is warranted. The negotiation may go through several rounds – demand, counteroffer, revised demand, etc. – before reaching an agreement. Patience and persistence are key. Your demand letter sets the stage; now you must continue to advocate using facts and logic to increase the offer. Each response from the insurer can be met with references back to your demand letter, reinforcing the detailed evidence and calculations that justify your claim. In this way, the demand letter serves as a foundation you keep building on during negotiations.

Gateway to Litigation if Negotiations Fail: If the insurer ultimately refuses to offer a fair settlement, the demand letter also lays the groundwork for the next step: filing a lawsuit. It’s often the last attempt to resolve the case before litigation. Should you proceed to court, that letter becomes an exhibit demonstrating how reasonable you were. It shows you gave the insurance company a chance to settle for a specific amount and they declined. This can be powerful in a courtroom if, say, a jury awards more than you demanded – it highlights the insurer’s refusal to settle when they had a clear opportunity. Moreover, in Georgia, a properly drafted time-limit demand that was not accepted can be the basis for a bad-faith claim later, arguing the insurer failed to act reasonably. Even before it gets that far, the mere fact that you have a written demand on record can sometimes spur a late settlement. Insurance companies know that once a lawsuit is filed, their costs and risks increase. Thus, the demand letter draws a line in the sand: it invites resolution, but if ignored, it signals you are prepared to escalate. As noted earlier, it also preserves your right to seek additional remedies. For instance, demand letters often explicitly state that if forced to litigate, you’ll seek all applicable relief, potentially including attorney’s fees. All of this puts the insurer on notice that delaying or ignoring your demand has consequences.

In summary, the demand letter is far more than a formality – it is a strategic tool that drives the negotiation process. It influences the insurer’s opening move, guides the trajectory of settlement talks, and sets the stage for what happens if those talks break down. A persuasive demand letter often leads to more meaningful offers and can shorten the length of negotiations by zeroing in on the key issues early. And if the case cannot be settled, that same letter strengthens your position going into litigation. For these reasons, personal injury attorneys put great effort into demand letters, and many adjusters respect a well-prepared demand. It’s the document that, in many cases, can help move a complex personal injury claim toward a successful resolution.

Related Articles